|

Getting your Trinity Audio player ready...

|

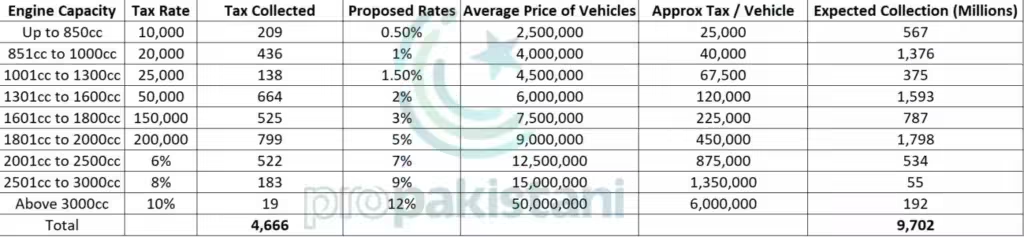

Islamabad, June 12, 2024 — The government has proposed a significant increase in the withholding tax on the purchase of new cars, according to the official budget announcement for the fiscal year 2024-25. This move is expected to impact car prices across the board, including vehicles with engine capacities ranging from under 850 cc to 2000 cc.

Proposed Withholding Tax Changes

| Car Engine Capacity | Current Withholding Tax | Proposed Withholding Tax |

|---|---|---|

| Under 850 cc | Fixed Amount | Percentage of Price |

| 850 cc to 2000 cc | Fixed Amount | Percentage of Price |

For instance, under the current tax regime, purchasing a Suzuki Alto priced at Rs. 2.5 million incurs a withholding tax of Rs. 10,000. Under the new proposal, this tax would increase to Rs. 25,000, significantly raising the cost for consumers.

Impact on the Auto Industry

The proposed tax hike comes at a challenging time for Pakistan’s auto industry, which is already grappling with low sales due to severe inflation affecting the purchasing power of consumers. To attract buyers, automakers have been offering numerous deals and discounts. However, the increased tax burden could further strain the industry and exacerbate the overall economic situation in the country.

Read Also: Budget 2024-25: Key Highlights And Salient Features

Impact on Electric Vehicles

Electric vehicles (EVs) are also targeted in the new budget proposals. The government plans to withdraw tax exemptions for EVs priced above $50,000, affecting high-end models such as the Audi e-Tron and e-Tron GT. This move could hinder the growth of the electric vehicle market in Pakistan, which is still in its nascent stage.

Current vs Proposed Withholding Tax Example

| Car Model | Price (Rs.) | Current Tax (Rs.) | Proposed Tax (Rs.) |

|---|---|---|---|

| Suzuki Alto | 2.5 million | 10,000 | 25,000 |

| Audi e-Tron GT | 12 million | Exempt | 1.5 million |

Additional Budget Proposals

- 18% Sales Tax on Tractors, Pesticides, and Fertilizers: This increase in sales tax is expected to affect the agriculture sector, raising costs for essential farming equipment and supplies.

- End of Tax Exemptions for Expensive Electric Vehicles: Removing tax benefits for EVs priced above $50,000 could discourage the adoption of cleaner technology.

Conclusion

While these budget proposals are yet to be approved, they signal a significant shift in the government’s approach to taxation in the auto and EV sectors. Consumers and industry stakeholders should keep a close watch on the final decisions, as these changes could have far-reaching implications for the market and the broader economy.

Stay tuned for more updates and detailed analysis on the 2024-25 budget proposals.

[…] Read Also: Budget 2024-25: Withholding Tax Increase on New Car Purchases […]