|

Getting your Trinity Audio player ready...

|

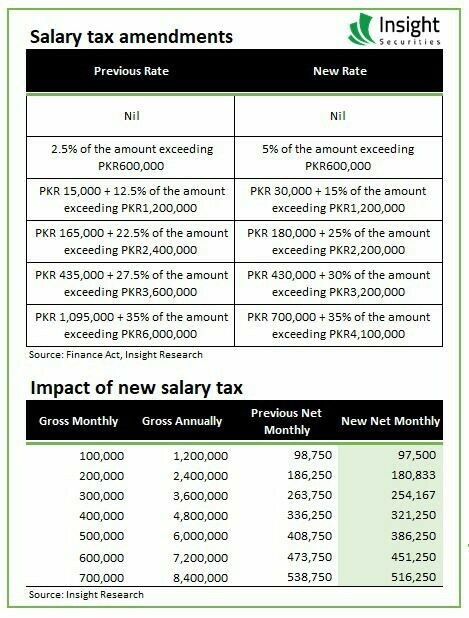

In the latest Federal Budget 2024-25 announcement, Finance Minister Muhammad Aurangzeb outlined significant changes to the salary tax rates for salaried individuals. While the specific details of the new slabs were not disclosed during his speech, subsequent analyses suggest that higher taxation will affect all income levels.

Read Also: Budget 2024-25: Key Highlights And Salient Features

Income Tax Slabs for Salaried Individuals In Federal Budget 2024-25

Aurangzeb mentioned that the slabs for the salaried group will undergo changes, leading to a restructured tax framework. These adjustments are designed to increase government revenue while maintaining an income tax exemption up to Rs0.6 million. However, the new tax rates indicate a higher tax burden on salaried individuals across various income brackets.

Salary Increases

To offset the impact of the increased taxation, the government has proposed salary increases for public sector employees. The exact percentage of the salary rise has not been specified yet, but it is expected to provide some relief against the higher income tax rates. This move aims to ensure that the increased tax burden does not adversely affect the net income of salaried employees.

[…] Read Also: Federal Budget 2024-25: Changes to Salary Tax Rates and Proposed Salary Increases […]