|

Getting your Trinity Audio player ready...

|

The Pakistan rupee displayed a slight recovery against the US Dollar today, opening at 281 in the interbank market. Initially bearish, it dipped to 281 during intraday trade but later stabilized. Despite other market indicators experiencing considerable declines, including the PSX and public sentiment, the PSX managed to reverse intraday losses and close positively.

Throughout the day, the interbank rate fluctuated between 279 and 281, ultimately closing at the same level. Open market rates on various currency counters remained within the 279-281 range.

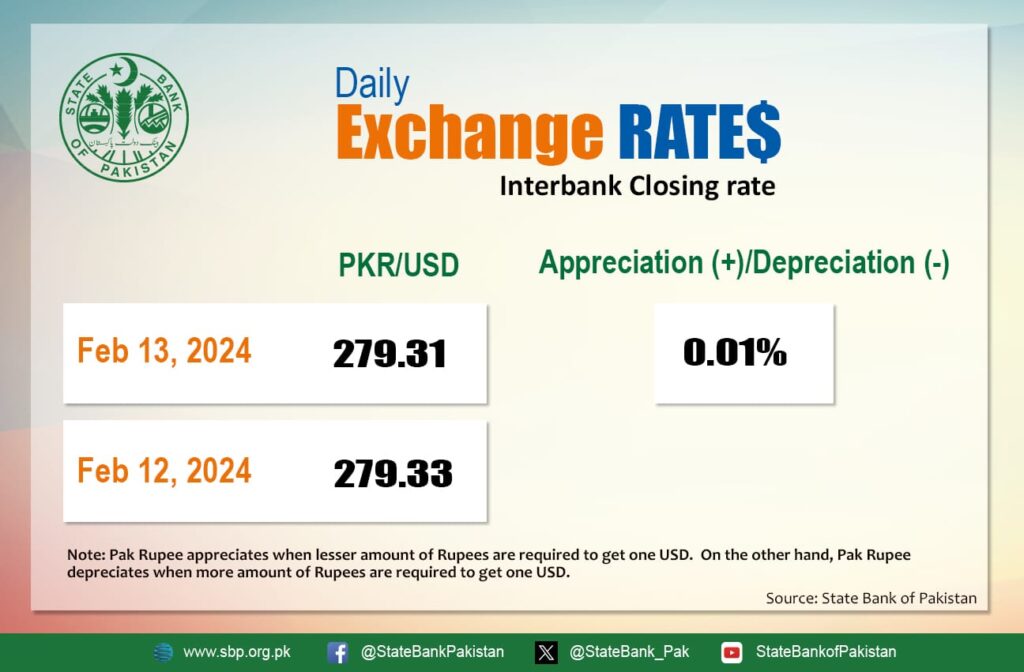

At the close, the PKR appreciated by 0.01 percent, reaching 279.31 after gaining two paisas against the dollar today.

While the rupee closed positively today, it had lost some ground the previous day. On a fiscal year-to-date basis, it has appreciated by 2.37 percent. However, the rupee has seen an overall decline of nearly Rs. 60 since January 2023 and a significant drop of over Rs. 107 against the US Dollar since April 2022.

In a significant development, the International Monetary Fund (IMF) rejected Pakistan’s rationalization and circular debt reduction measures. IMF’s Mission Chief to Pakistan, Nathan Porter, expressed doubts about the CD neutrality of the tariff rationalization plan, highlighting potential additional burdens on vulnerable households. Despite reassurances from the Energy Ministry (Petroleum Division), the IMF remains open to collaborating on a sustainable reform plan.

Read Also: IMF Delays Final Tranche Negotiations Until New Government Forms

In the interbank market, the PKR showed strength against most major currencies today, remaining stable against the Saudi Riyal (SAR) and the UAE Dirham (AED). It gained six paisas against the Australian Dollar (AUD) and 76 paisas against the Euro (EUR). Conversely, it lost six paisas against the Canadian Dollar (CAD) and 18 paisas against the British Pound (GBP) in today’s currency market.