|

Getting your Trinity Audio player ready...

|

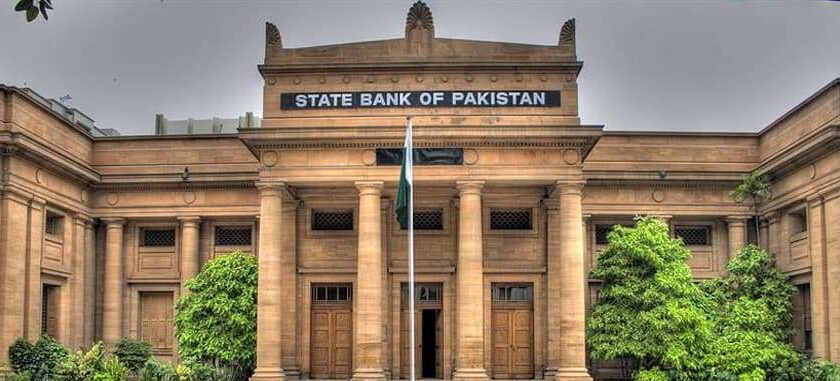

In Karachi, the State Bank of Pakistan (SBP) has directed financial institutions to guarantee convenient, timely, and trouble-free access to a comprehensive array of financial services, including credit, deposits, and payments, for farmers. During the annual Agricultural Credit Advisory Committee (ACAC) meeting, State Bank of Pakistan Governor Jameel Ahmed disclosed that despite formidable challenges such as floods, agricultural credit disbursements for FY23 achieved an impressive level of Rs1,776 billion, marking a year-on-year growth of 25.2 percent and attaining 97.6 percent of the Rs1,819 billion overall target.

Governor Ahmed expressed confidence in the agriculture sector’s robust recovery, anticipating a projected real GDP growth of 2-3 percent in FY24. He disclosed that the disbursement target for FY24 stands at Rs2,250 billion, representing a 26.7 percent increase from the previous year’s disbursements.

Noting a stellar growth of 30 percent during July-October FY24, Governor Ahmed expressed optimism about meeting and surpassing the disbursement target, urging banks to intensify their efforts accordingly. Recognizing challenges, particularly borrower attrition, the governor informed the committee of the State Bank of Pakistan intention to engage with each bank individually to formulate plans and strategies for a sustainable increase in agricultural borrowers.

Governor Ahmed advised banks not only to enhance their agrifinance capacity but also to establish partnerships with microfinance institutions (MFIs) to broaden the outreach of agricultural and rural finance services. He emphasized the critical need to enhance farmers’ productivity to reduce risks for banks, urging collaboration with AgriTechs, Agricultural Universities, Provincial Agricultural Departments, and other stakeholders to improve farming practices and optimize agri-tech utilization.

Highlighting the plight of small farmers, Governor Ahmed stressed the importance of facilitating them in obtaining market-competitive prices for their produce, suggesting that banks connect them with large and reputable buyers.

He also underscored the significance of promoting developmental loans specifically directed towards mechanizing the agriculture sector, advising banks to assess the feasibility of financing agri-service providers supplying machinery and equipment to farmers on a rental basis.

Read More:https://dusknews.com/category/business/