|

Getting your Trinity Audio player ready...

|

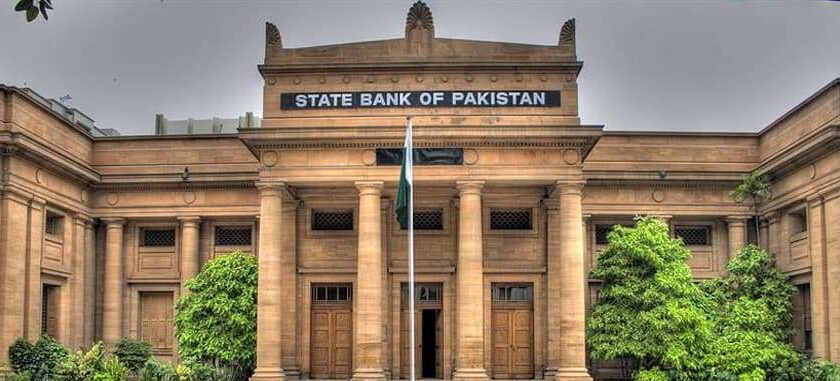

In a landmark move, the State Bank of Pakistan (SBP) has reduced the interest rate by 150 basis points to 20.5%, effective June 11, 2024. This decision marks a departure from the central bank’s previous stance, where the key lending rate remained unchanged for seven consecutive sessions.

First Rate Cut in Four Years

This is the first time in four years that the SBP has cut its key lending rate, with the last rate cut occurring on June 25, 2020. The Monetary Policy Committee (MPC) noted that the significant decline in inflation since February was largely in line with expectations, with the May outcome surpassing earlier projections.

Read More: Pakistan’s Upcoming Budget 2024-25: Tax Proposals and Implications

Underlying Inflationary Pressures Subside

The Committee assessed that underlying inflationary pressures are subsiding due to tight monetary policy and fiscal consolidation. Core inflation has continued to moderate, and inflation expectations among consumers and businesses have eased in recent surveys.

Key Developments Since Last Meeting

The MPC highlighted several key developments since its last meeting, including:

– Moderate real GDP growth of 2.4% in FY24, driven by strong agriculture growth and subdued recovery in industry and services.

– A reduction in the current account deficit, leading to improved FX reserves despite large debt repayments and weak official inflows.

– The government’s approach to the IMF for an Extended Fund Facility program, expected to unlock financial inflows and further build up FX buffers.

– Declining international oil prices and rising non-oil commodity prices.

Appropriate Time for Rate Cut

Based on these developments, the Committee deemed it an appropriate time to reduce the policy rate, considering the real interest rate remains significantly positive and will continue guiding inflation to the medium-term target of 5-7%.

Data-Driven Monetary Policy Decisions

The Committee emphasized that future monetary policy decisions will remain data-driven and responsive to evolving developments related to the inflation outlook.

Real Sector

Latest estimates indicate real GDP growth at 2.1% in Q3-FY24 against a contraction of 1.1% in the same quarter last year. While agriculture was already showing strong growth, industry also witnessed positive growth in Q3. Also, initial growth estimates for both Q1 and Q2 for FY24 were revised upward. Taking into account the developments in the first nine months, FY24 growth is provisionally estimated by PBS at 2.4% against a contraction of 0.2% in FY23.

External Sector

The current account posted a surplus for the third consecutive month in April on the back of robust growth in remittances and exports, which more than offset the uptick in imports. During July-April FY24, the current account deficit narrowed significantly to $202 million. In the same period, exports grew by 10.6%, mainly driven by an increased quantum of rice and HVA textile exports. Conversely, imports decreased by 5.3% during the same period due to lower international commodity prices, better domestic agriculture output, and moderate economic activity.

Fiscal Sector

Fiscal indicators continued to show improvement during July-March FY24. The primary surplus increased to 1.5% of GDP, while the overall deficit remained almost at last year’s level. A large part of this improvement reflected the impact of an increase in tax and PDL rates, higher SBP profit, and lower energy sector subsidies.

Money and Credit

The broad money (M2) growth decelerated to 15.2% y/y on May 24, 2024, from 17.1% as of end-March 2024. This reduction was primarily due to a deceleration in the growth of net domestic assets of the banking system.

Inflation

Headline inflation decelerated to 11.8% in May 2024 from 17.3% in April. Besides the continued tight monetary policy stance, this sharp reduction was also driven by a sizeable decline in prices of wheat, wheat flour, and some other major food items, along with the downward adjustment in administered energy prices. Core inflation also decelerated to 14.2% from 15.6%.

[…] Read Also: State Bank of Pakistan Announces Significant Interest Rate Cut […]