|

Getting your Trinity Audio player ready...

|

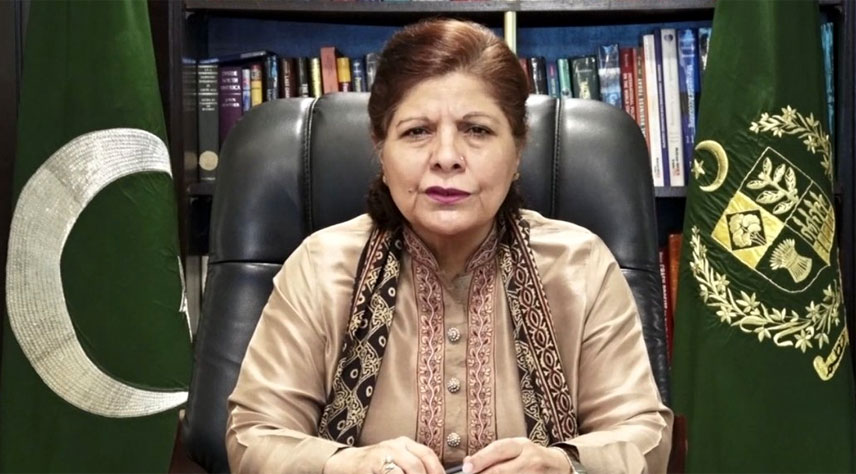

In a recent Economic Coordination Committee (ECC) meeting, the interim Finance Minister, Dr. Shamshad Akhtar, has reportedly pointed fingers at both previous PTI and coalition (PDM+PPP) administrations for significant Forex Borrowing over the past five years to cover domestic expenses. This borrowing has substantially increased Pakistan’s foreign debt burden, according to informed sources cited by Business Recorder.

Dr. Akhtar made these statements while discussing a Finance Division proposal titled “addendum to the Subsidiary Grant Agreement (SGA) – Financial inclusion & Infrastructure Project and exemption from Re-lending Policy for release of funds to SBP” during the ECC meeting. The proposal pertains to the Financial Inclusion and Infrastructure Project (FIIP), a World Bank-funded initiative launched in 2017 with an initial portfolio of $137 million. Originally designed for a five-year period, the project faced delays due to floods in 2022 and the impact of Covid-19, leading to a 30-month extension until June 2025.

The FIIP comprised three main components, with $127.6 million allocated for components 1 & 3 to be executed by the State Bank of Pakistan (SBP) and $9.4 million for component 2 by the Central Directorate of National savings (CDNS). However, component 2 faced delays, resulting in a repurposing of $9.24 million for flood-affected households under component 3.

Read More: Government Grapples with Surging Debts and Liabilities: PSEs’ Burden at Rs2,333bn

The ECC had granted an exemption from the specified terms in the Re-lending Policy for $127.6 million in December 2017. A Subsidiary Grant Agreement (SGA) was signed in March 2018 between the Economic Affairs Division (EAD) and SBP for the provision of the grant. Following repurposing, Finance Division directed the creation of a special Reserve Fund by SBP, totaling $136.39 million for execution of components 1 and 3.

Dr. Akhtar highlighted the need to reduce dependence on foreign loans for local expenditure and urged the SBP, as a regulator, to refrain from engaging in business activities, emphasizing its role in adhering strictly to its designated functions. Additionally, she suggested that the SBP should fund such purposes from its own resources. The Finance Division proposed the reclassification of funds allocated to SBP and sought approval for modifications through an addendum to the SGA between SBP and EAD. The discussion emphasized the importance of addressing these financial challenges to ease the burden on Pakistan’s foreign debt.