|

Getting your Trinity Audio player ready...

|

Revolutionizing Banking: PBA’s Shared e-KYC Platform and Global Trends in Customer Onboarding

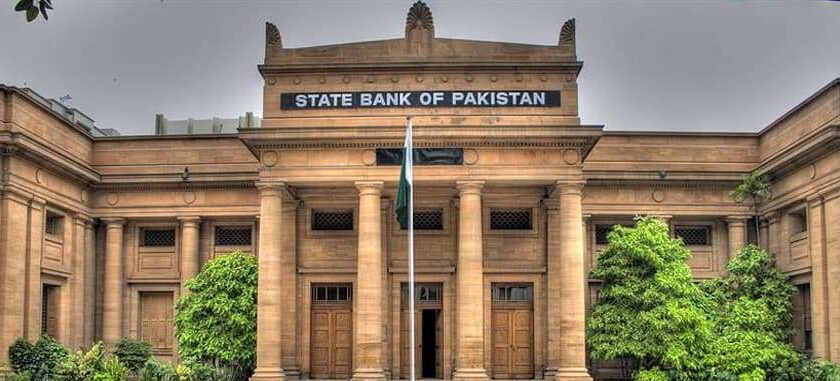

The Pakistan Banks Association (PBA) has introduced a groundbreaking platform, known as the “Shared E-KYC Platform”, designed to enhance the onboarding experience for new customers and reduce operational costs for banks. This initiative, launched under the guidance of the State Bank of Pakistan (SBP), aims to streamline the KYC process in the banking industry.

Avanza Group Collaboration: PBA’s Journey Towards Blockchain-Based National e-KYC Banking”

In a significant move, the PBA, representing its member banks, entered into a partnership with the Avanza Group for the development of Pakistan’s inaugural blockchain-based national e-KYC banking platform. This collaboration, managed by the PBA, aligns with the SBP’s ongoing efforts to fortify Anti-Money Laundering (AML) and Combating the Financing of Terrorism (CFT) controls in the country.

The Avanza Group spearheaded the project with its innovative e-KYC platform, ‘Consonance,’ leveraging blockchain technology to enable banks to standardize and exchange details via a decentralized and self-regulated network, all with the explicit consent of their customers.

Shared e-KYC Initiatives Globally:

The concept of shared e-KYC, as highlighted in the “Central KYC (C-KYC)” report by PwC, has seen implementation in various countries, including India. Unlike Pakistan, India’s shared e-KYC is accessible to numerous financial institutions, streamlining the KYC process and eliminating the need for customers to submit documents multiple times.

In India, the C-KYC, initiated by the Central Registry of Securitization and Asset Reconstruction and Security Interest of India (CERSAI), has successfully streamlined the KYC process. As of March 31, 2023, the C-KYC record registry hosts over 70 crore KYC records, encompassing approximately 50% of India’s total population.

The Reserve Bank of India (RBI) took a step further on August 16, 2023, initiating a pilot program for the Public Tech Platform for Frictionless Credit. This innovative program consolidates data from C-KYC to streamline credit appraisals, facilitating various types of loans without collateral.

Such initiatives, as outlined in a recent report by Karandaaz on open banking in Pakistan, contribute to the broader digital open banking ecosystem, fostering shared KYC and enabling digital banks to tap into existing customer bases through embedded finance partnerships. This collaborative approach holds the potential to significantly improve market entry capabilities for digital banks, reducing the trial-and-error phase in areas such as consumer segmentation and product pricing.

Read More: Dusk News business