|

Getting your Trinity Audio player ready...

|

UBank growth analysis -The eagerly awaited financial statements of U Microfinance Banks (UBank) have finally surfaced, though there was a slight delay in their release. Following the revelation of the half-yearly report on December 1, 2023, UBank promptly followed up with the financial statements covering the nine months ending in September. While these recently disclosed statements have provided answers to certain questions regarding previous speculations, they have, on the whole, sparked curiosity and interest within the financial sector.

Read Also :UBank’s Rs5bn Equity Surge – A Turning Point for Microfinance Banks in Pakistan

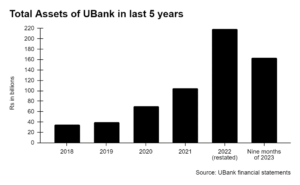

Financial Adaptation: The notable aspect contributing to this intrigue is UBank’s apparent departure from its previously unconventional and deemed overly aggressive approach. This approach had resulted in an astonishing threefold growth in its balance sheet amidst industry turmoil in 2022. However, a discernible change has surfaced: the bank has experienced a sharp decrease in investments in government securities and mutual funds on the asset side, coupled with a significant reduction in borrowing on the liabilities side.

Of greater concern, the equity of UBank has declined from around Rs 7 billion to Rs 5 billion in the span of these nine months. This prompts the question: Is there a possibility that UBank, once hailed as one of the biggest microfinance banks, may lose its status if its balance sheet continues to contract?