|

Getting your Trinity Audio player ready...

|

Introduction

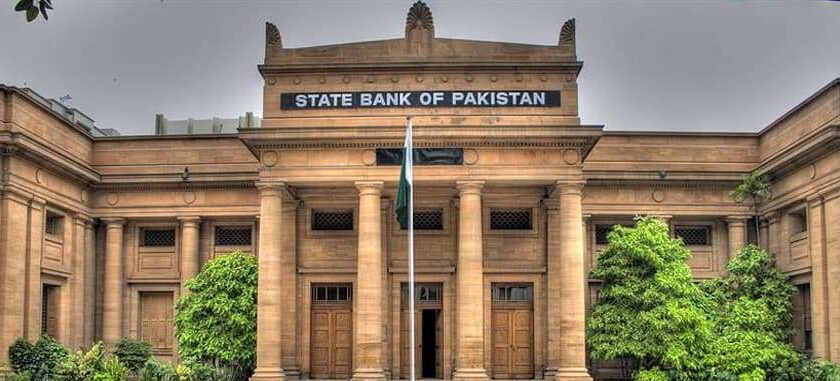

In a strategic move, the State Bank of Pakistan (SBP) recently affirmed its commitment to uphold the policy rate at 22%, as declared during the December 12, 2023, Monetary Policy Committee (MPC) meeting. This decision, in harmony with analysts’ forecasts, follows a sequence of rate adjustments earlier in the year. Let’s delve into the intricacies of this pivotal decision and explore its far-reaching implications for the economic landscape.

The Road So Far: SBP Policy Rate Adjustments in 2023

The SBP had previously increased the policy rate by 100 basis points to 22% in an emergency meeting in June, anticipating an agreement with the International Monetary Fund (IMF). Since then, the rate has remained unchanged in subsequent meetings held on July 31, September 14, October 30, and the latest one on December 12.

Analysts’ Projections and Economic Indicators

A Reuters poll of 12 analysts revealed a consensus, with most projecting no change in rates. However, one analyst advocated for a 100 basis point cut. The MPC considered various developments, including the finalization of the staff-level agreement with the IMF, GDP growth in Q1 2024, and positive shifts in consumer and business confidence.

Inflation Targets and Policy Suitability

Affirming the current monetary policy stance, the committee emphasized its suitability to achieve the inflation target of 5-7% by the end of fiscal year 2025. This assessment hinges on sustained fiscal consolidation and timely external inflows realization.

Balancing Factors: Gas Prices, Inflation, and Economic Realities

The recent hike in gas prices in November posed a challenge, contributing to higher-than-expected inflation. However, balancing factors such as the drop in international oil prices and increased agricultural produce availability could offset these effects.

Understanding Real Interest Rates

The MPC emphasized the positive real interest rate on a 12-month forward-looking basis, anticipating a gradual decline in inflation. This concept plays a crucial role in encouraging savings, as a positive real interest rate protects against inflation, influencing consumer spending and demand.

Inflation Projections and IMF Guidance

Following the IMF agreement, the SBP maintains a tight monetary policy to counter inflation. Despite initial projections of declining inflation, November’s figures showed a slight increase. The MPC remains optimistic, expecting a significant decline in the second half of fiscal year 2024.

Economic Recovery: Sectors and Indicators

The MPC anticipates a moderate recovery in real GDP for fiscal year 2024. While the agriculture and manufacturing sectors show improvement, the services sector lags. Positive shifts in the current account balance, reduced deficit, increased exports, and improved remittances contribute to a strengthening economy.

Fiscal Indicators and External Financing

Fiscal indicators point to positive growth in tax and non-tax revenues, emphasizing the need for sustained fiscal consolidation. The SBP’s profit release to the government for fiscal year 2023 increased significantly, supporting fiscal operations. The governor highlighted the external financing requirements for fiscal year 2024, including rollovers and principal payments.

Future Outlook and Data-Driven Decision Making

The governor emphasized a data-driven approach for future policy rate adjustments, considering factors like inflation and currency movements.

Conclusion

In conclusion, the SBP’s decision to maintain the policy rate reflects a cautious stance in the face of economic dynamics. While challenges persist, positive indicators hint at a resilient economy poised for recovery.

اس کو اگر ایمان داری سے چلایا جئے قوم کو بزنس کی طرف لایا جائے سرکاری نگریوں سے قوم کی جان چھڑوائ جائے توہم دنیا کے ساتھ چل سکتے ہیں

جی